Matching Items (1,530)

Filtering by

- Creators: Marine Biological Laboratory Archives

Description

Schennach (2007) has shown that the Empirical Likelihood (EL) estimator may not be asymptotically normal when a misspecified model is estimated. This problem occurs because the empirical probabilities of individual observations are restricted to be positive. I find that even the EL estimator computed without the restriction can fail to be asymptotically normal for misspecified models if the sample moments weighted by unrestricted empirical probabilities do not have finite population moments. As a remedy for this problem, I propose a group of alternative estimators which I refer to as modified EL (MEL) estimators. For correctly specified models, these estimators have the same higher order asymptotic properties as the EL estimator. The MEL estimators are obtained by the Generalized Method of Moments (GMM) applied to an exactly identified model. The simulation results provide promising evidence for these estimators. In the second chapter, I introduce an alternative group of estimators to the Generalized Empirical Likelihood (GEL) family. The new group is constructed by employing demeaned moment functions in the objective function while using the original moment functions in the constraints. This designation modifies the higher-order properties of estimators. I refer to these new estimators as Demeaned Generalized Empirical Likelihood (DGEL) estimators. Although Newey and Smith (2004) show that the EL estimator in the GEL family has fewer sources of bias and is higher-order efficient after bias-correction, the demeaned exponential tilting (DET) estimator in the DGEL group has those superior properties. In addition, if data are symmetrically distributed, every estimator in the DGEL family shares the same higher-order properties as the best member.

ContributorsXiang, Jin (Author) / Ahn, Seung (Thesis advisor) / Wahal, Sunil (Thesis advisor) / Bharath, Sreedhar (Committee member) / Mehra, Rajnish (Committee member) / Tserlukevich, Yuri (Committee member) / Arizona State University (Publisher)

Created2013

Description

This paper examines dealers' inventory holding periods and the associated price markups on corporate bonds from 2003 to 2010. Changes in these measures explain a large part of the time series variation in aggregate corporate bond prices. In the cross-section, holding periods and markups overshadow extant liquidity measures and have significant explanatory power for individual bond prices. Both measures shed light on the credit spread puzzle: changes in credit spread are positively correlated with changes in holding periods and markups, and a large portion of credit spread changes is explained by them. The economic effects of holding periods and markups are particularly sharp during crisis periods.

ContributorsQian, Zhiyi (Author) / Wahal, Sunil (Thesis advisor) / Bharath, Sreedhar (Committee member) / Coles, Jeffrey (Committee member) / Mehra, Rajnish (Committee member) / Arizona State University (Publisher)

Created2012

Description

This paper looks at defined contribution 401(k) plans in the United States to analyze whether or not participants have plans with better plan characteristics defined in this study by paying more for administration services, advisory services, and investments. By collecting and analyzing Form 5500 and audit data, I find that there is no relation between how much a plan and its participants are paying for recordkeeping, advisory, and investment fees and the analyzed characteristics of the plan that they receive in regards to active/passive allocation, revenue share, and the performance of the funds.

ContributorsAziz, Julian (Author) / Wahal, Sunil (Thesis director) / Bharath, Sreedhar (Committee member) / Barrett, The Honors College (Contributor) / Department of Information Systems (Contributor) / Department of Finance (Contributor)

Created2015-05

Description

This report is a summary of a long-term project completed by Ido Gilboa for his Honors Thesis. The purpose of this project is to determine if an arbitrage between different crypto-currency exchanges exists, and if it is possible to acts upon such triangular arbitrage. Bitcoin, the specific crypto-currency this report focuses on, has become a household name, yet most do not understand its origin and patterns. The report will detail the process of collecting data from different sources, manipulating it in order to run the algorithms, explain the meaning behind the algorithms, results and important statistics found, and conclusion of the project. In addition to that, the report will go into detail discussing financial terms such as triangular arbitrage as well as information system concepts such as sockets and server communication. The project was completed with the assistance of Dr. Sunil Wahal and Dr. Daniel Mazzola, professors in the W.P. Carey School of business. This project has been stretched over along period of time, spanning from early 2013 to fall of 2015.

ContributorsGilboa, Ido (Author) / Wahal, Sunil (Thesis director) / Mazzola, Daniel (Committee member) / Department of Information Systems (Contributor) / Department of Supply Chain Management (Contributor) / Barrett, The Honors College (Contributor)

Created2015-12

Description

Natural Language Processing (NLP) techniques have increasingly been used in finance, accounting, and economics research to analyze text-based information more efficiently and effectively than primarily human-centered methods. The literature is rich with computational textual analysis techniques applied to consistent annual or quarterly financial fillings, with promising results to identify similarities between documents and firms, in addition to further using this information in relation to other economic phenomena. Building upon the knowledge gained from previous research and extending the application of NLP methods to other categories of financial documents, this project explores financial credit contracts, better understanding the information provided through their textual data by assessing patterns and relationships between documents and firms. The main methods used throughout this project is Term Frequency-Inverse Document Frequency (to represent each document as a numerical vector), Cosine Similarity (to measure the similarity between contracts), and K-Means Clustering (to organically derive clusters of documents based on the text included in the contract itself). Using these methods, the dimensions analyzed are various grouping methodologies (external industry classifications and text derived classifications), various granularities (document-wise and firm-wise), various financial documents associated with a single firm (the relationship between credit contracts and 10-K product descriptions), and how various mean cosine similarity distributions change over time.

ContributorsLiu, Jeremy J (Author) / Wahal, Sunil (Thesis director) / Bharath, Sreedhar (Committee member) / School of Mathematical and Statistical Sciences (Contributor) / School for the Future of Innovation in Society (Contributor) / Barrett, The Honors College (Contributor)

Created2020-05

Description

The purpose of this thesis is to investigate the history of the Bitcoin arbitrage premium to see if the possibility of 'risk-free' gains existed previously and whether or not the opportunity is still present today. It investigates market structure and price discrepancies in $147B of trading volume across 53 different exchanges between July 2010 and February 2017. This paper aggregates exchange trading into five minute buckets of transaction volume in order to see what exchange volume could have been successfully arbitraged within the context of two cases. The first requires trades to close within the same 5-minute interval and the second requires a 10-minute delay before the position is closed. It finds that the monthly average spreads of these cases have fallen below 3% in 2017 from nearly 10% in 2010. Once exchange fees are included, these spreads fall below 2% on average.

ContributorsNowicki, Gregory Arthur (Author) / Wahal, Sunil (Thesis director) / Simonson, Mark (Committee member) / School of Mathematical and Statistical Sciences (Contributor) / Department of Finance (Contributor) / Barrett, The Honors College (Contributor)

Created2017-05

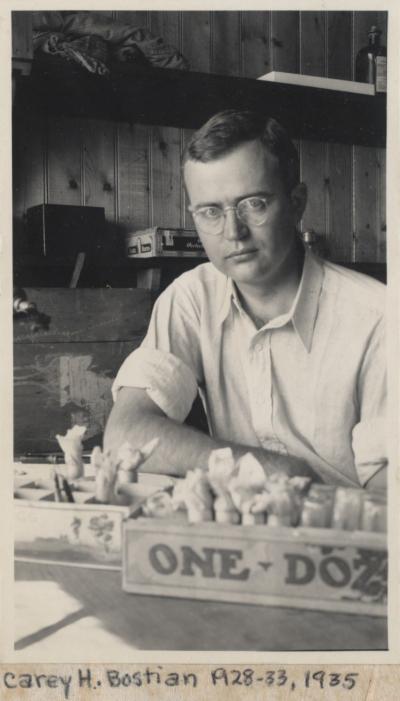

ContributorsMarine Biological Laboratory Archives (Publisher) / Arizona Board of Regents (Publisher)

Created1935

ContributorsHuettner, Alfred F. (Alfred Francis), b. 1884 (Creator) / Marine Biological Laboratory Archives (Publisher)

Created1918

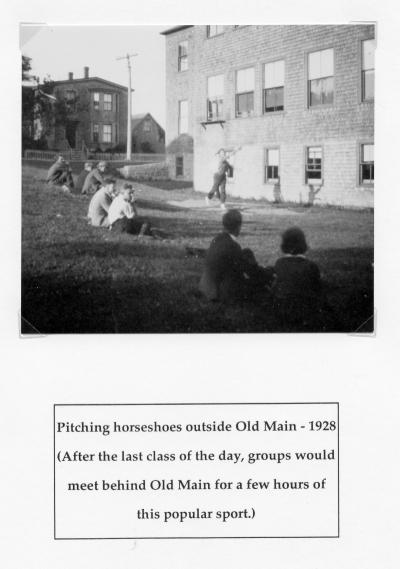

ContributorsMarine Biological Laboratory Archives (Publisher)

ContributorsHuettner, Alfred F. (Alfred Francis), b. 1884 (Creator) / Marine Biological Laboratory Archives (Publisher)

Created1928